Preparing for next year 🧭

As the year comes to a close, it’s a great time to reflect. How could we do things differently next year?

In this issue:

- 🧠 Mindset: Do less, but better

- 💰 Wealth: Make a simple money plan

- 📖 More: How to know when to walk away

🧠 Mindset: Do less, but better

What am I avoiding? What’s the most important thing to do?

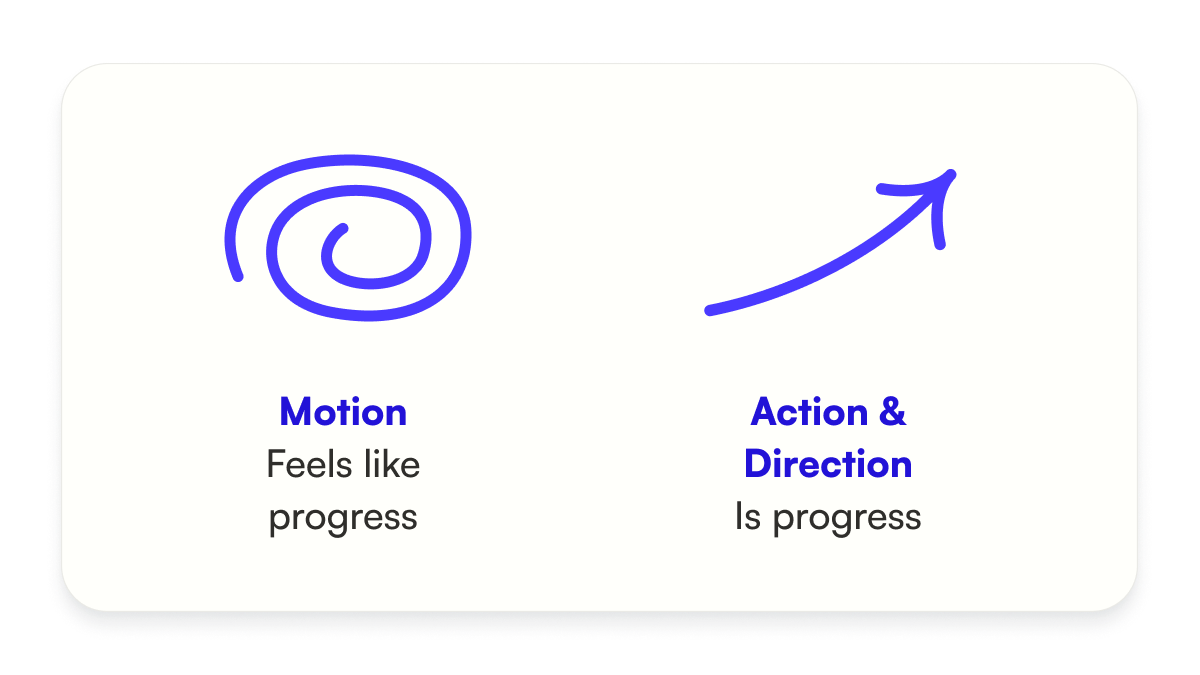

Sometimes it’s easier to procrastinate by doing other things, without making meaningful progress.

💰 Wealth: Make a simple money plan

Planning can be useful, but plans change. Setting up an easy-to-maintain system makes it easier to keep up with it, especially when life gets a bit chaotic.

Here are 6 ideas you could try to make a simpler money plan:

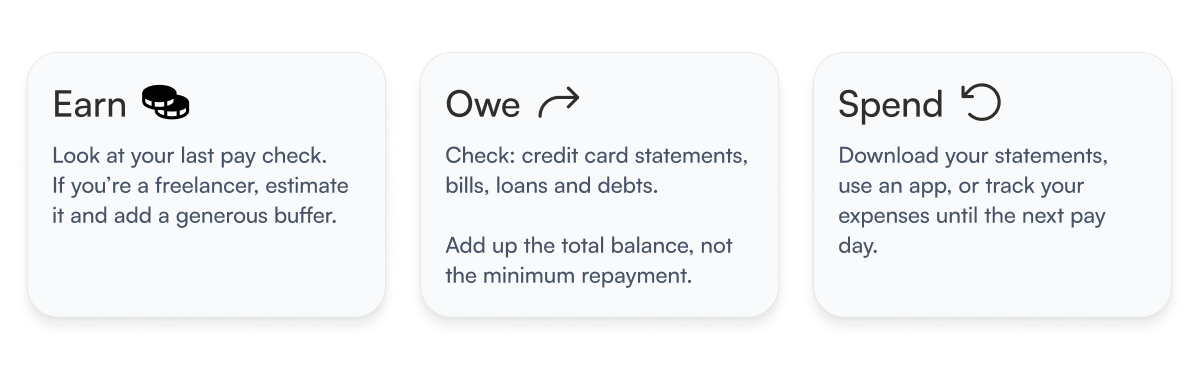

1. Start where you are

Find out how much you earn, owe, and spend.

2. Use the tools you’re familiar with

Stick with what you prefer, whether that’s pen and paper, note taking apps like Notion, spreadsheets, or a budgeting app. You can always shift to a new tool later.

3. Define what you want to achieve

Ideally, it’s a goal you can control - not based on other people’s input. Goals can also be flexible; it doesn’t have to be a pass/fail.

Ask: Is this something that I can still get value from, even if the goal isn’t reached?

4. Automate admin The initial set-up is worth the long-term peace of mind, especially when we're busy or sick.

I direct debit most of my bills, and set reminders to make sure there’s enough money in the account ahead of time.

5. Set milestones and celebrate progress

We all have to start somewhere. These milestones are a great way to check if there’s anything you want to do differently.

Appreciate what you’re doing; you’re planting seeds of your future growth!

6. Build compassion for yourself

If the plan crumbles, don’t beat yourself up — we also need to work with the seasons of your life. Meaningful change happens over time, trial, and error.

📖 More: How to know when to walk away

Grit can help us stick to hard things that are worthwhile, but they can also make it hard to walk away, even when we’re getting less value.

"Success doesn’t lie in just sticking to things carelessly; it’s picking the right thing and quitting the rest." —Annie Duke

Here's 6 things I learnt from Quit, by Annie Duke. I'd really reccomend this book - it's an engaging and thought-provoking read.

1. Quitting at the right time, usually* feels like quitting too early

*when you’re in the losses.

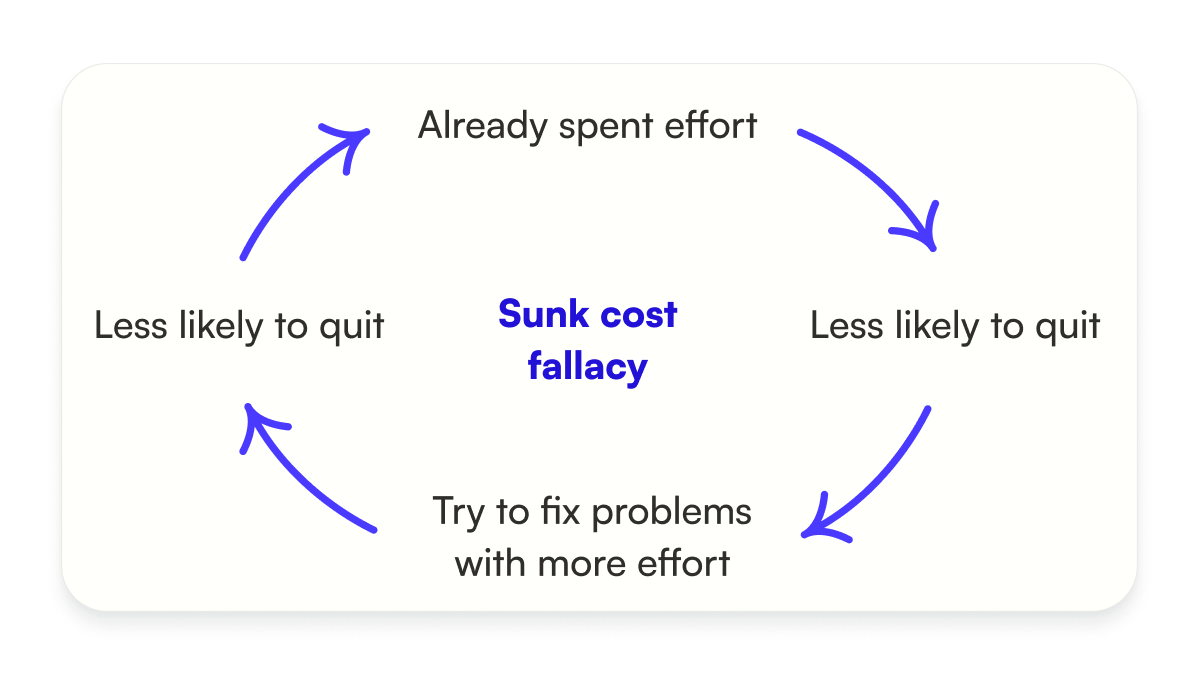

2. When things aren’t going well, we tend to work harder, so our work doesn't go to waste

This is called a sunk cost fallacy, and even large corporations aren't immune to this bias.

3. When facing ambitious goals, solve the hard things first

This helps us learn if it's worth continuing quicker, and prevent sunk costs.

Be cautious of preferring the illusion of progress over quitting and "admitting defeat".

4. Prepare the criteria to quit before we have to make the decision

When the decision is pressing, we're usually not in a good place to decide. By getting ready ahead of time, we can help our future selves remember the signs.

![Use this sentence to remind future you of the signs that it's time to walk away: If by [date] I have/haven't [reached a particular state], I'll quit.](https://www.kinadesy.com/content/images/2022/12/Image-Blog---9-1.png)

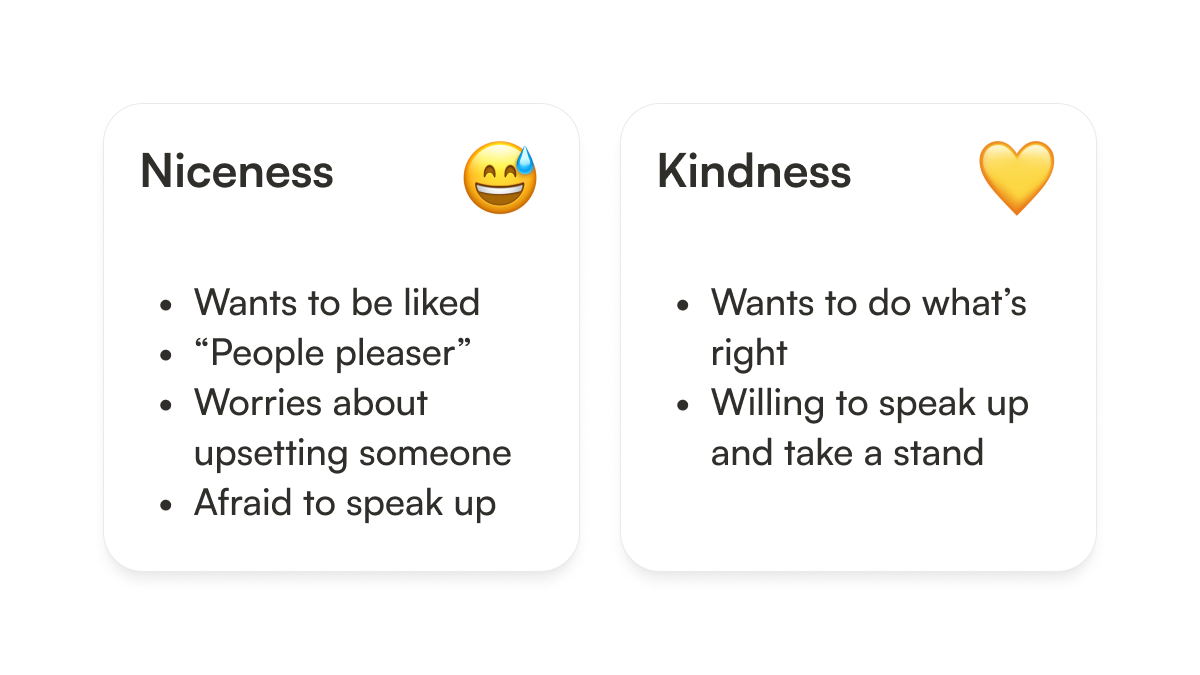

5. Someone on the outside looking in can usually see things better

Talk to someone who cares more about your long-term happiness than about not hurting your feelings right now – someone kind, not nice.

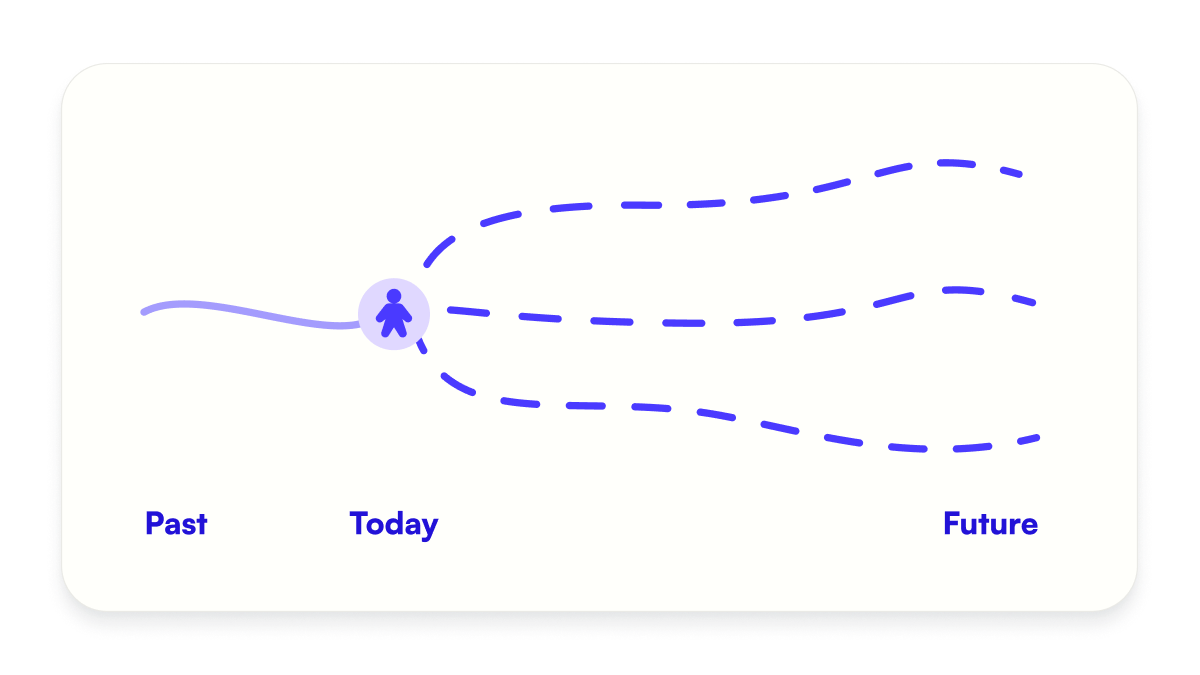

6. Waste is a problem for the future, not the past

Quitting generally triggers 2 fears: that we’ve failed, and that we’ve wasted our time, effort or money.

Worry more about continuing to waste time, effort, or money - we can’t change what’s already done.

Want to share this issue of Mindful Money Mondays? Copy and paste this link: https://kina.digital/2-prep-next-year

Have feedback? Reply to this email - every bit helps shape what I write.

Until next week,

Kina 💛