20+ resources to learn about money

An ongoing list of resources that have helped me understand my money mindset better, and learn how to build wealth sustainably.

I’ll try to update this page as I find better resources to share. Please use what works for you, change what doesn’t, and read the full disclaimer here.

Don't know where to start?

It's easier to start from a specific situation - what's on your mind at the moment? Do you want to know more about a problem or answer a specific question?

What's your favourite way to learn? This can include: reading, listening, watching, doing, or a mix!

Before taking something in, ask yourself: What are these resources trying to sell me? How are they making money? This helps us understand why people support or go against something, so we can make an informed decision.

Watch

For educational breakdowns: Two Cents

Educational videos that answers a range of questions like Can you really retire in your 30s? and Why it's more expensive to be poor.

One of the hosts is a Certified Financial Planner. The show is sponsored by PBS, a non-commercial TV network based in the US.

For practical tips to manage money: Steve Antonioni

A Canadian that quit a high-paying job in finance to make educational content full-time. He runs a course called Cash College.

He shares a lot of practical tips for saving & investing, and shows how to do it yourself. He also explains finance jargon like 'yield curves' in a simple way, and makes beautiful videos.

Read

I started by reading and listening to these books because they help build a strong foundation. Even if it's not written for the country you live in, you can still learn a lot from these books!

For Kiwis that want to learn the basics: Rich Enough? by Mary Holm

Mary covers the basics of personal finance for Kiwis really thoughtfully. She's an experienced personal finance journalist and founding director of the Financial Markets Authority (FMA).

To spend more on what you love: I Will Teach You to Be Rich by Ramit Sethi

Ramit talks about spending intentionally on what you love, focusing on doing what's good enough instead of trying to be perfect, and automating investments. The tone is more motivational, and written for people in the United States. You can read the first chapter here.

For ideas on how to think about money: The Psychology of Money by Morgan Housel

Morgan talks about how our ego, motivations, and fears can influence what we do with our money. It's a series of short stories, written in a clear tone. You can also read their blog here.

For practical tips and thoughts: The Deep Dish by Richard Meadows

A personal finance columnist that went all-in to save his first $100k, interviewed Mr. Money Mustache (the unofficial leader of the FIRE movement) quit his full-time job at 25, authored a book called Optionality, and is starting to blog again.

Some of his articles that I really like are:

- 100+ Money Saving Tips to Slash Your Spending

- Net Worth Tracking: The No-Bullshit Metric For Financial Success - I still use the free spreadsheet he links!

- The Optionality Approach to Getting Lucky

Listen

Sometimes it's nice to listen to an episode while going about your day. Here are podcasts that I enjoy:

It's No Secret

A podcast that talks about money, investing, and more with a focus on transparency. Cat used to work as a financial adviser in Australia, which helps bring a lot of experience into her discussions with Christine. Cat and Christine, the hosts, are part of the marketing team at Kernel.

Cooking the Books with Frances Cook

Every week, Frances talks to NZ experts about current money questions. She's a seasoned journalist who writes about business and finance. She's also the author of Tales from a Financial Hot Mess (based on her true story) and Your Money, Your Future.

She's On The Money

Victoria is an Australian financial adviser who's a huge advocate for thinking about your money story & money mindset. Victoria and her team explain today's money topics in a really simple, approachable way. They also have a Money Diaries series, where people from a variety of backgrounds share their story.

Follow

I've also found it helpful to change up what I see on social media. Often, the posts are short, which is a nice way to remind myself.

Educational accounts

Girls That Invest | @girlsthatinvest

Sim and Sonya are best friends that talk about how to invest and grow wealth, without the jargon on their podcast. Simran has a certificate in Financial Markets (US), and recently wrote a book of the same name that covers the basics of investing.

Others on their wealth building journey

It can be helpful to see how other people do things, but keep in mind that we're all on our own path with different resources, goals, and backgrounds 🤗

Hidden Figures | @the.hiddenfigures

Are 2 Māori investors that are huge advocates for growth mindsets and getting rid of Buy Now Pay Later debt (e.g: Afterpay, Laybuy, Zip, etc.). They own 5 properties, have invested 120k in stocks, and a net worth above $1,000,000.

Amy | @moneywithaims

Is a Risk Manager based in Australia that's a huge advocate for spending on what you value, and regularly breaks down her spending, how she approached salary increases, etc. She also shares resources like spreadsheets, and sells some Google Sheets templates.

Communities

Facebook Groups

Facebook is a great way to connect with other likeminded people and learn about different perspectives.

- For tips to live cheaper: Cheaper Ways NZ and Cheaper Living™ (NZ only!)

- For a safe space to discuss money with other women: She's On The Money and Girls that Invest

If you join these groups, spam accounts might message you directly, so be careful and block them, especially if they offer an "exciting opportunity", ask you for money, or mention other buzzwords like "crypto" "easy, effortless money". If it's sounds too good to be true, it probably is.

Reddit is such an underrated source of information. Often, if I have a question, I Google "What my question is + reddit", and I'll find some useful discussion threads.

Since users are anonymised, people can be more candid when discussing things. Of course, it also reminds us to take what online strangers say with a grain of salt.

- r/personalfinancenz - or if you're overseas, look up your country! Others include r/AusFinance, r/PersonalFinanceCanada, and r/UKPersonalFinance.

- r/FIRE - stands for Financial Independence Retire Early, which has a bunch of specialised categories like FatFIRE, CoastFIRE, NomadFIRE

Other resources & tools

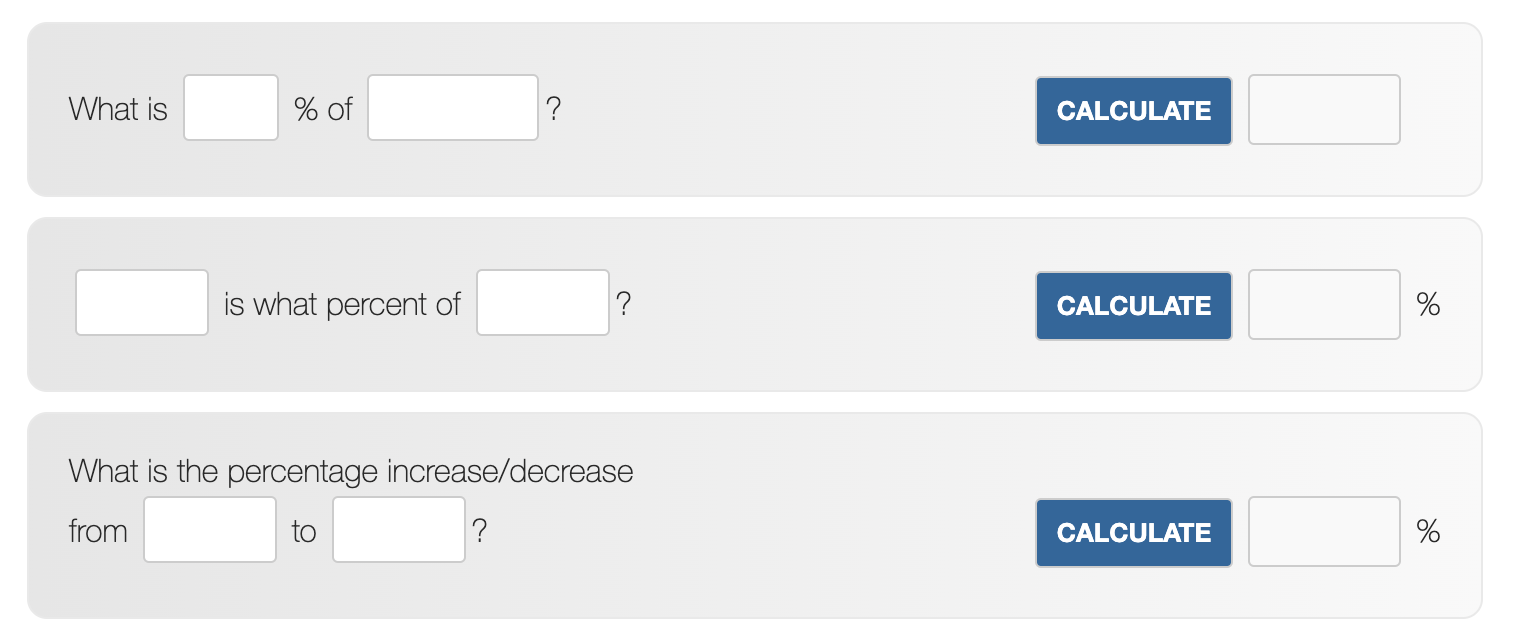

To figure out how much of a change something is: Percentage Calculator

I really like the way this calculator phrases things as sentences - I find it helpful to count things like:

- How much would it be if I saved an extra 5% off each paycheck?

- How much am I spending/saving?

- How much of a raise/pay cut is this?

To compare financial products and services: Moneyhub

Moneyhub is a well researched site that compares financial products to answer questions like "Should I use Sharesies, Investnow, or Hatch?" and "What credit card will give me the best bang for my buck?".

Some articles that I found helpful are:

For parents and families that want to prepare: Crayon

Whether you're a new, expecting, aspiring or thriving parent, Crayon has a growing toolkit to help you plan and become the parent you want to be. Some of my favourite resources from them include:

- A (Free!) Baby Gear List, so you can estimate costs for your newborn, with prices ranging from essentials, useful items, and nice-to-haves.

- Series: How to invest for your kids, with a free simulator spreadsheet that accounts for best-case, average, and worst-case scenario.

- Blog: How to bridge the Kiwisaver Pregnancy Gap

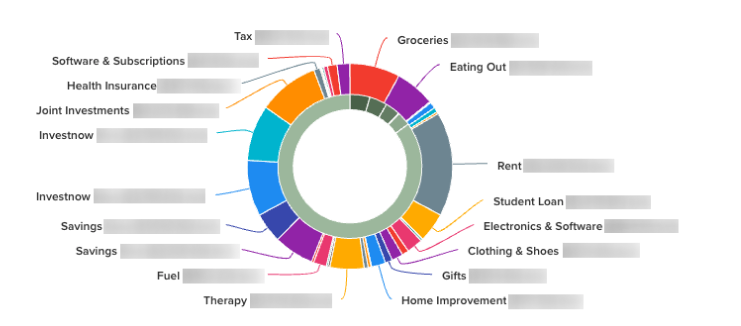

To track spending: Pocketsmith

I just don't have the energy to go through multiple bank & credit card accounts to see what my money has gone towards. Instead, I prefer to set up automated systems to save me time in the long term.

Pocketsmith connects with all my accounts so I can see everything I spent and earnt in 1 place and categorise it in minutes, regularly.

They have a free tier with manual imports, or you can trial a free month here - full disclosure, I'll get 2 months free if you convert to a paid plan, but no pressure! It's a Kiwi company, so it fits most NZ bank accounts & financial service providers.

A quick note on getting 'budgeting app' tools like this - the cost is generally either:

- Spending time to manually upload regularly

- Allowing companies to sell your data, or

- Paying for the privacy (what I've opted for!)

I personally don't mind using an app to link to my bank accounts - although for some people, this isn't ideal. In that case, a spreadsheet or manual tracking app might be a better option.

For guides and tools for your money planning: Sorted

Sorted has a bunch of blogs, guides, and tools, including a money personality quiz, savings calculator, and more.

It's a free service, funded by Te Ara Ahunga Ora Retirement Commission. It's a government-funded, independent agency dedicated to helping New Zealanders get ahead financially.

For free, confidential support and financial mentorship: MoneyTalks

A financial mentor can help you plan for the future, organise your budget, and help you get rid of your debts.

MoneyTalks is run by FinCap, which is a non-government organisation that is funded by the Ministry of Social Development's Building Financial Capability initiative.

You can also get in touch by emailing them at help@moneytalks.co.nz or text them at 4029.

There you have it: more than 20 resources about money - hope it was useful!

I'd love to know what resources you find helpful. Get in touch by:

- Mentioning @heykina on Twitter or DMing me @kinanti.desy on Instagram.

- For longer or private feedback, you can email me. I read 100% of emails, but can't guarantee that I'll reply, especially in a timely manner.

Disclaimer

- All opinions are my own and is not a reflection of my employers.

- The information here is general in nature, and for educational purposes only. It has no intention of constituting financial advice - do not rely on it for investment or financial decisions.

- This content is not personalised to your individual needs; I am not a qualified financial adviser, and therefore can only provide information for general purposes.

- Investing involves risk. You aren’t guaranteed to make money and you might lose the money you start with.

- If you’re looking for personalised financial, legal, tax or other expert advice based on your situation, please seek assistance from a professional adviser. I cannot accept liability for any decisions made based on the information shared.

- I cannot guarantee that everything on this website will always be perfectly accurate, factual, and correct. I link to other websites, tools, and resources, but take no responsibility for the content they publish.

- Use the information provided on my website and social media channels at your own risk, always do your research, and use due diligence.